Blog

Key Steps and Best Practices for Capitalized Commissions under ASC 606

July 13, 2024

Key Insights

Here is the problem: your sales rep closed a deal in the first quarter. But the whole onboarding process finished in the second quarter. You paid the commission in the third quarter.

Now to which quarter does this expense fall?

Each company will have a distinct solution on how to handle this situation. And that is how things were before ASC 606 as well.

When ASC 606 was established, sales commissions got a more structured and uniform way of accounting in the financial statement.

So what changes happened in the capitalization of commission under ASC 606?

Let's read.

What are Capitalized Commissions?

Capitalized commissions refer to the expense that the company incurs when onboarding a new customer or selling a product.

Instead of adding the whole amount as a single expense in the balance sheet, it is spread across the customer's life or contract validity period.

For example, a sales rep earns a commission of $1200 for acquiring a new customer. Instead of recording this amount as a single expense, it is distributed over the contract's validity.

If the validity of the contract is 12 months, the sales commission expense will be spread out as $100/ month for the duration of the contract.

This capitalized commissions recognition approach matches the expense of the commission with the revenue it helped generate over time.

What is ASC 606?

Accounting Standards Codification 606 (ASC 606) is a revenue recognition standard set by the Financial Accounting Standards Board (FASB).

It draws a standardized framework for companies to record the money they make from selling products and services.

Enforcing a standard practice will ensure consistency among the revenue recognition practices of all companies in the same industry.

In addition, it provides clearer information about your revenue generation and financial health.

Why did authorities implement ASC 606?

Previous to ASC 606, there were a lot of discrepancies in the way each company and each industry went about their revenue recognition.

In short, there was no uniformity at all.

These inconsistencies created a lot of confusion and complexities while evaluating the financial performance of companies, and tracking their revenue reporting to name a few.

To resolve these issues, the authorities implemented ASC 606. The result was:

- Brought consistency in the revenue recognition practices across all industries.

- Created a standardization to compare the financial performance among companies.

- Enhanced clarity and transparency in the company’s revenue generation and financial health.

- Established guidelines on how to handle multiple and complex transactions.

- ASC 606 is closely aligned with International Financial Reporting Standards 15.

The implementation of ASC 606 was a need of the hour. It brought consistency, uniformity, clarity, and transparency to financial reporting where it didn't exist before.

How does ASC 606 impact the accounting process?

ASC 606 has revolutionized the accounting process.

It has drawn clear demarcations on how to go about with each specifics of accounting- giving it a proper structure and framework.

Here are the areas that ASC 606 has made an impact on your accounting process:

Enhanced transparency in financial statements

ASC 606 made it mandatory to specify the contract nature, the number of performance obligations, and the transaction price. This brings clarity and transparency.

Defined timing for revenue recognition

Now businesses can recognize their revenue only when the promised product/service is completely transferred to the customer. Making revenue recognition timing streamlined.

Standardized recognition process across industries

ASC 606 brings standard practices to each industry. This helps investors and stakeholders to easily evaluate and compare financial performance and health.

Guided contract modification

ASC 606 has made clear and specific guidelines on handling contract changes and variable payments. This ensures accurate and transparent accounting of these factors.

At large, the ASC 606 impact can be read as bringing a proper structure to the erstwhile haphazard accounting and revenue recognition.

With the coming of this new guideline, businesses have improved the reliability, comparability, and transparency of their financial health and performance.

What are the steps to prepare your business for ASC 606?

There is a way of revenue recognition you have been doing till now.

With the coming of ASC 606, you might feel that everything has been toppled and you have to start from scratch.

Since ASC 606 is legally binding, you must make updates in all relevant areas of your business.

So if you feel like you are back to square one, do not worry.

We have designed a step-by-step checklist to help you prepare for the requirements of ASC 606.

Understand the Standard

Begin by studying the basics. Understand the details of ASC 606 and how it differs from the previous revenue recognition standards.

Assess Current Practices

Evaluate your current practices. Review your current revenue recognition practices to understand which areas will be impacted by the new standard.

Review Contracts

Gather and review all your existing contracts. Work on including the required details like performance obligation and revenue streams to enhance transparency and clarity.

Determine Amortization Period

The previous practices of writing off the amount as a single expense. ASC 606 calls for amortization of expenses. You must learn about the specifics of determining your amortization period for accurate revenue recognition.

Train Staff

ASC 606 is altogether new for your accounting and finance team. Providing them required training and education to understand the changes and how they impacted their work.

Update Financial Systems

There was an established process and tool that helped you manage your financial resources. With ASC 606 you need to update all these to adapt to the new requirements.

Review and Adjust Financial Statements

Your financial statements once contained the required information to go about with the traditional revenue recognition practices. With the implementation of ASC 606, there are additional columns to accommodate the newer requirements.

Ongoing Monitoring

You need to implement a system where you consistently monitor changes happening in the revenue recognition practices. This will help in remaining updated as needed.

Revenue recognition will undergo changes on and off.

This means you need to keep an open ear on the updates happening. Only through ongoing monitoring can you ensure compliance with the new revenue recognition standards.

How did ASC 606 affect commission policy?

ASC 606 has had a significant impact on commission policy.

To begin with, it has brought changes in how companies recognize and report sales commissions in their financial statements.

Previous to ASC 606, the sales commission would be expenses entirely immediately after the sale was made.

With the new revenue recognition standards, the commission is first capitalized and then amortized, thereby matching cost with revenue.

Let’s break down this “capitalized”, “amortized” and “cost with revenue” into simpler parts.

Earlier sales commissions were marked as an expense immediately after the sale was made. Now under ASC 606, sales commissions are capitalized or recognized as an asset in the balance sheet.

Earlier, sales commissions were marked as a one-time expense on the balance sheet. Under ASC 606, this capitalized commissions cost is amortized or spread out over the length of the customer contract.

With these measures, the timing of the commission expense is matched with the revenue it helps to generate.

The new approach under ASC 606 thus provides a clearer picture of profitability and more accurate financial reporting.

Potential Risks Associated with Implementing ASC 606

It’s true that ASC 606 has paved a path for revenue recognition.

But that doesn't mean it's without challenges and potential risks.

There are areas that businesses need to keep a close eye on to manage effectively.

So what are these potential risks that are associated with implementing ASC 606:

Complexity in the implementation process

ASC 606 standards come with a lot of complexity. Not understanding these clauses or misapplying them can result in inaccurate financial reporting and non-compliance.

Incompatibility of the system to support newer requirements

Your existing financial systems need to be upgraded timely to meet the requirements of the current recognition practices. This can be a costly and time-consuming process that can disrupt your day-to-day operations.

Complex data collection and management process

ASC 606 required detailed data collection on contracts, performance obligations, revenue recognition, etc. Inadequate data collection can lead to errors in revenue recognition.

Requirement for upgraded internal controls and compliance

Your weak or outdated methods and measures for revenue recognition can lead to non-compliance with the new standards. Timely review and update of these internal methods will ensure accurate financial reporting.

Impact on financial metrics and investor communication

The new revenue recognition rules can impact the existing financial metrics. Investors and stakeholders will feel concerned when changes in revenue, profitability, and cash flow metrics occur,

Though these challenges exist, it is not without solutions.

Learning more about the ASC 606 standards, being open to system updates, keeping your data management accurate, and having transparent communication can help overcome these challenges.

Best Practices for Managing Accounts under ASC 606

You are obliged to follow the standards lined up by ASC 606.

You have to boot up to adapt to its requirements and overcome the potential challenges.

But here is a piece of advice.

Including a few best practices can help you better cope with these new and changing rules and standards.

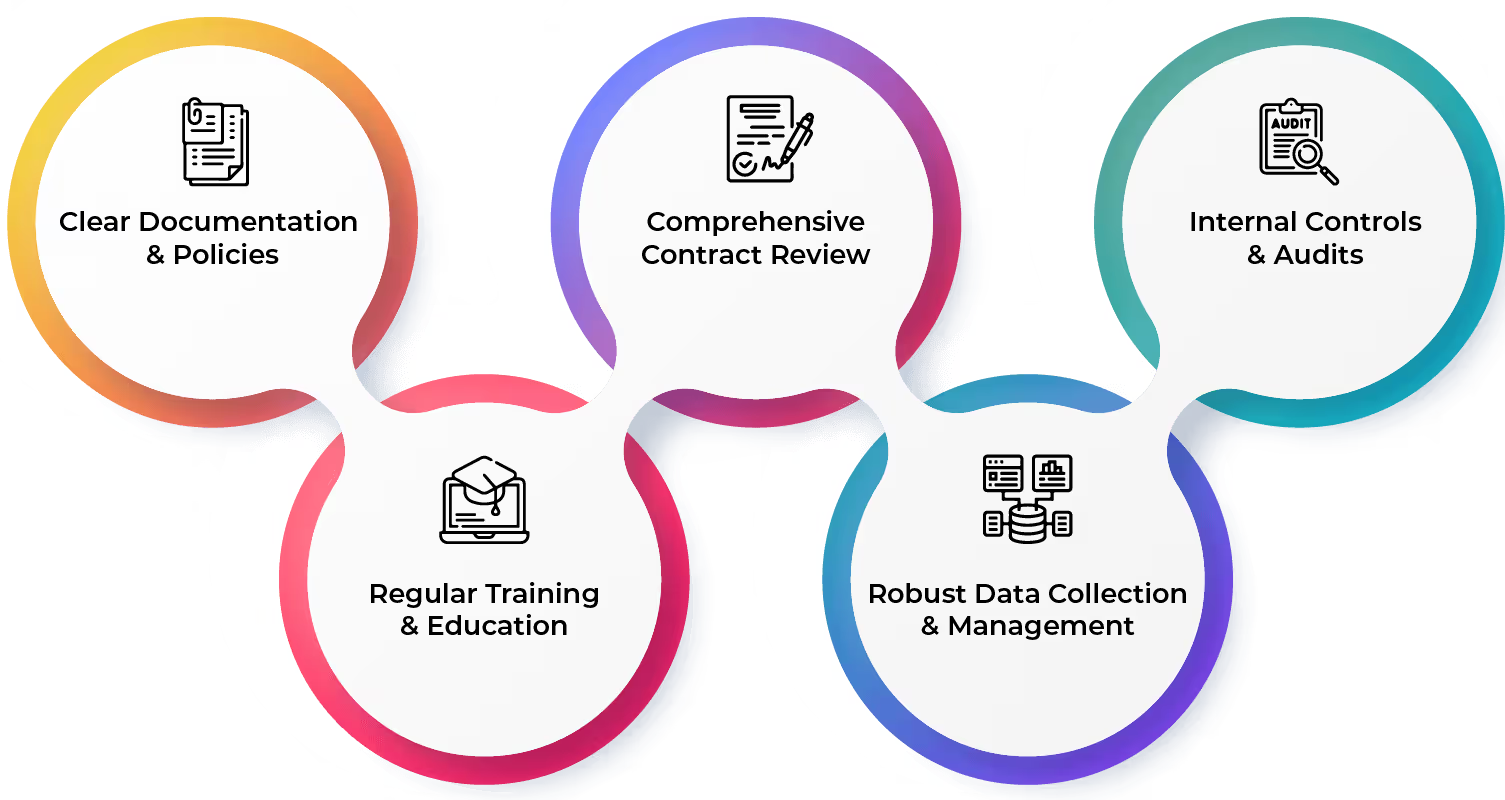

Here are the top five best practices that help you manage your accounts under ASC 606:

Clear Documentation and Policies

Maintain clear documentation of revenue recognition policies and procedures. This will help in keeping track that you align with ASC 606 guidelines.

Regular Training and Education

Keeping updated with the ASC 606 guidelines can become tedious. Provide regular training sessions for the finance, accounting, and sales teams to help them understand the ASC 606 requirements.

Comprehensive Contract Review

ASC 606 has laid down strict guidelines on contracts with customers. Ensure you follow the five-step process and comply with the ASC 606 principles.

Robust Data Collection and Management:

Accurate data collection means accurate revenue recognition. Implement systems that help capture and store data to comply with the ASC 606 requirements.

Internal Controls and Audits

Establish and maintain a strong internal process to monitor your ASC 606 compliance. Conduct regular audits to ensure there are no discrepancies in revenue recognition.

Including these best practices as a part of your everyday revenue recognition process will help manage accounts under ASC 606.

Is there any software that can help with ASC 606?

There are many software solutions that can help with ASC 606 compliance.

Of it all, sales commission automation software will be a good solution to potentially assist you with ASC 606.

Here are a few ways, sales commission automation tools like Kennect help comply with ASC 606:

To begin with, automation software can accurately calculate capitalized commissions based on predefined rules and rates. This means it can be configured to align with commission structures required under ASC 606.

It can generate detailed reports and provide an audit trail of commission calculations and payments. This will be a good help in documenting compliance with ASC 606 requirements.

Many commission automation tools integrate with financial systems. This ensures that commission data is correctly reflected in financial statements prepared under ASC 606.

Some automation platforms offer flexibility to customize commission structures and rules. This will allow businesses to align their commission policies with ASC 606 guidelines effectively.

Now a sales commission automation tool can help you only to an extent. It can help you comply only with certain aspects of ASC 606.

This means, businesses must not compromise on their training and documentation part as no software is an absolute substitute for understanding the principles and requirements of the standard.

The Future of Sales Compensation

The future of sales compensation lies in automation.

We have reached a point where it is inevitable for businesses to walk away from sales comp automation tools.

The data visibility, accuracy in commission calculation, reduced administrative work, and real-time tracking of sales achievements only enhance its desirability.

When businesses stay away from investing in automation tools, what they don't realize is the undetected revenue leakage that happens because of a lack of digital solutions.

With data-driven decision-making becoming the vogue of the time, old-school business operations devoid of it will be scoffed at.

For businesses wishing to stay relevant and competent in their industry with a strong salesforce, then automation is what you need to endorse.

Final Thoughts

From an erstwhile autonomous way of doing things, revenue recognition has gone a long way in becoming standardized under ASC 606.

The biggest milestone happened in the accounting of sales commissions.

With the sales journey being long, the closing of deals happening at one point, and commission paid at another, the balance sheet looked haphazard.

The greatest of all these issues was that companies did this documentation in their way without any uniformity with others in the same industry.

All these led to further confusion and complexity.

With ASC 606, revenue recognition was brought under an umbrella. Companies belonging to the same industry started following similar practices and processes.

Though a lot has been made uniform, there is still complexity with the rules and clauses.

Incorporating automation tools can make these responsible and routine processes easy and streamlined.

Know more about how sales commission automation from Kennect.

We help you automate your entire sales incentives process, saving you time and ensuring accuracy. Book A Demo NOW

ReKennect : Stay ahead of the curve!

Subscribe to our bi-weekly newsletter packed with latest trends and insights on incentives.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Your data is in safe hands. Check out our Privacy policy for more info